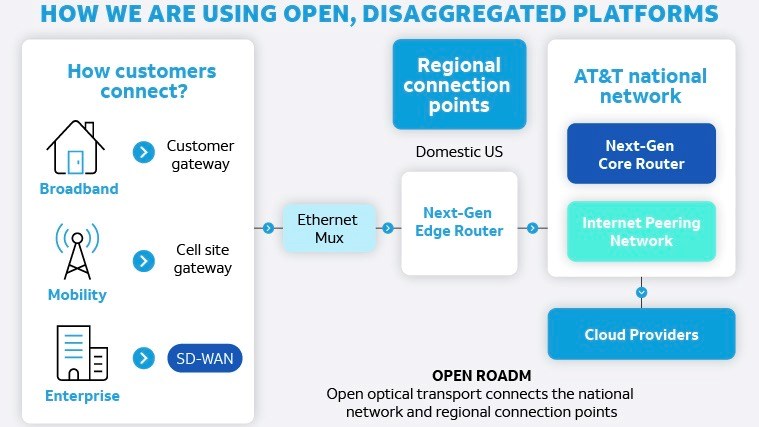

How AT&T is using disaggregated systems in its production network.

- AT&T has long had a network function virtualisation strategy

- It introduced disaggregated core routers at least three years ago

- Now the majority of its backbone traffic is transported via these next-generation platforms

- And AT&T is adopting open, disaggregated systems in multiple parts of its network

AT&T has been talking about the virtualisation of its network functions for almost a decade, starting with its Domain 2.0 vision that set out its plans based on white box hardware platforms – and not just talking about, but actually adopting and deploying disaggregated, software-defined systems in its live production network, with its core routing platform being a prime example.

The giant US operator has just provided an update on its network function disaggregation progress by publishing a blog authored by Mike Satterlee, its vice president of network core infrastructure services. He noted that the initial rollout of disaggregated core routing technology began in 2020, as reported by TelecomTV at the time, followed swiftly by the introduction of virtualised edge routing functionality using the same underlying white box hardware (but with different software).

From the very beginning, AT&T’s key next-generation core router partners were DriveNets, which began developing its Network Cloud software stack about six years ago, and Broadcom (for its Jericho2 switch/router silicon).

And now, according to the operator, 52% of its core transport network traffic is running via its disaggregated routing platform. “Being entrusted with AT&T’s core network traffic – and delivering on our performance, reliability and service availability commitments to AT&T– demonstrates our solution’s strengths in meeting the needs of the most demanding service providers in the world,” said Ido Susan, founder and CEO of DriveNets, in an announcement that coincided with AT&T’s blog post. “We look forward to continuing our work with AT&T as they continue to scale their next-gen networks,” he added.

The DriveNets story is a remarkable one: Founded in 2016 by serial networking sector entrepreneur Ido Susan, it quickly secured a place in AT&T’s plans and attracted industry talent and investment to fund its R&D and growth plans. To date the company has raised a staggering $587m – its most recent funding round, in August last year, was $262m – and it has been working with other progressive network operators, such as Japan’s KDDI – see Virtual router vendor DriveNets raises $262m for further expansion.

If anything, the DriveNets story shows that it’s possible to break into the telecom market’s most competitive sectors, as the Israeli specialist is going head to head with some of the biggest names in the data networking industry, including Cisco, Juniper, Nokia and Huawei.

But DriveNets isn’t the only company that has made the cut at AT&T as the operator shifts further away from traditional integrated networking systems.

In its edge routing domain, which plays a very important role in supporting enterprise and consumer data services (including 5G and fibre-to-the-home broadband), AT&T is deploying white box hardware from Taiwan-based UfiSpace, which is housing Broadcom’s Jericho2 chips and routing software from Cisco. It is also being deployed at AT&T’s Internet peering points. (So keep in mind this means that Cisco’s IOS XR software is running on another company’s hardware platform – this is disaggregation in action!)

For its cell site gateway routing platform, once again the hardware is from UfiSpace housing Broadcom Qumran-AX chips and Ciena’s Vyatta network operating system (NOS) software. (Note here that the Vyatta software was once part of the AT&T empire – see Ciena to acquire AT&T’s virtual routing unit as revenues ramp further.

For its disaggregated Ethernet service aggregation systems, Broadcom Qumran-AX chips and Ciena’s SAOS Network Operating System software is running on hardware from EdgeCore, while the operator’s universal customer premises equipment (CPE), which enables high-speed internet and SD-WAN services, comprises hardware components from Israel-based Silicom Connectivity Solutions that house chips from a variety of vendors (Broadcom, Intel, Marvell) and the Vyatta NOS from Ciena.

And in the optical transport domain, AT&T has Open reconfigurable optical add/drop multiplexer (ROADM) systems from a host of major vendors (Ciena, Cisco, Fujitsu, Infinera, and Nokia) running at more than 75 nodes.

“We are continuing to develop the open and disaggregated ecosystem to enable more advanced management capabilities and additional use cases,” noted Satterlee in his blog. “The task now is to unlock its full potential and make its capabilities more consumable and flexible for our customers.”

It’s taken a while, but the tide is turning at AT&T towards disaggregated systems that combine best-of-breed elements from multiple suppliers, instead of monolithic, integrated systems from single suppliers that control the pace of innovation. Expect to see more developments of this type at other operators in the coming years as such systems are proven to be viable and reliable.

- Ray Le Maistre, Editorial Director, TelecomTV

Email Newsletters

Sign up to receive TelecomTV's top news and videos, plus exclusive subscriber-only content direct to your inbox.