Save Costs Today with Cloud-Native Networking

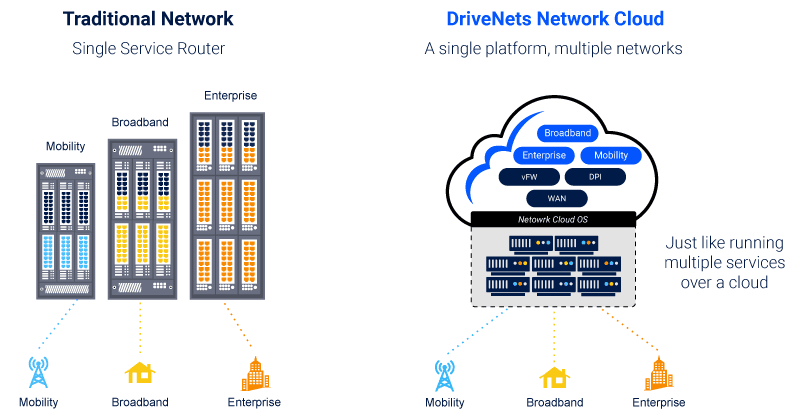

Most networks today are hardware-centric. Basically, these networks have been built the same way over the past three decades, with many different proprietary network-specific hardware devices. Not only that, but these hardware-centric networks are typically operated in silos, where each domain (e.g., broadband, mobile) has its own dedicated hardware resources.

Such hardware-centric networks are not taking advantage of newer software technologies that enable improved economic models, better resource utilization, and high service scaling. Regarding utilization, for example, only some 30-40% of hardware-centric network capacity is utilized, while cloud utilization of hyperscalers (e.g., Google, Facebook/Meta) is around 80-90%.

How Networking Boxes Have Changed

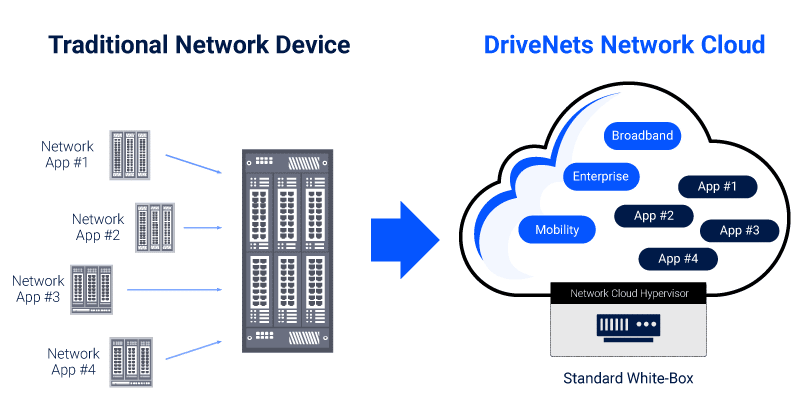

Today, the networking boxes (chiefly routers) that are the building blocks of hardware-centric networks cannot share their resources. This means they cannot be used for multiple network applications simultaneously, like hyperscalers build networks do with their clouds.

DriveNets introduces a modern way of running and managing networks – just like cloud. With DriveNets Network Cloud, the network infrastructure is a shared resource leading to significant cost savings through higher resource utilization and economies of scale.

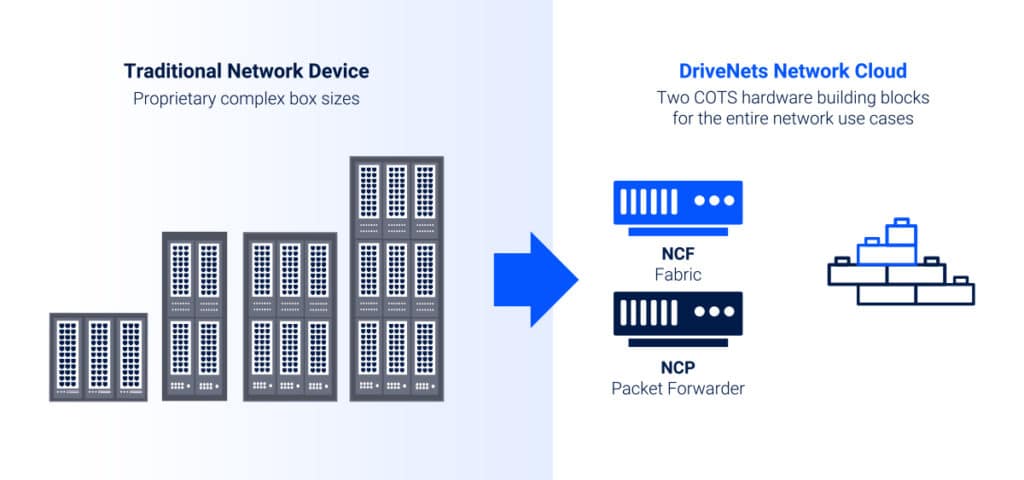

On top of that, DriveNets network architecture, in contrast to the hardware-centric model, uses just two types of basic commercial off-the-shelf (COTS) building blocks that are available from multiple vendors. The same hardware can be used across all network types (mobile, broadband, enterprise) and configurations (core, aggregation, edge). The bottom line is that this open hardware is less expensive to purchase, inventory and maintain than closed legacy hardware.

Overcome Supply Chain Issues for Network Service Providers

Cisco recently announced that it is expecting significant supply chain delays due to the current chip shortage. As a result, many service providers undertook premature, price-inflated purchasing to stockpile network equipment inventory, with the aim of not having to wait long periods for future chip delivery.

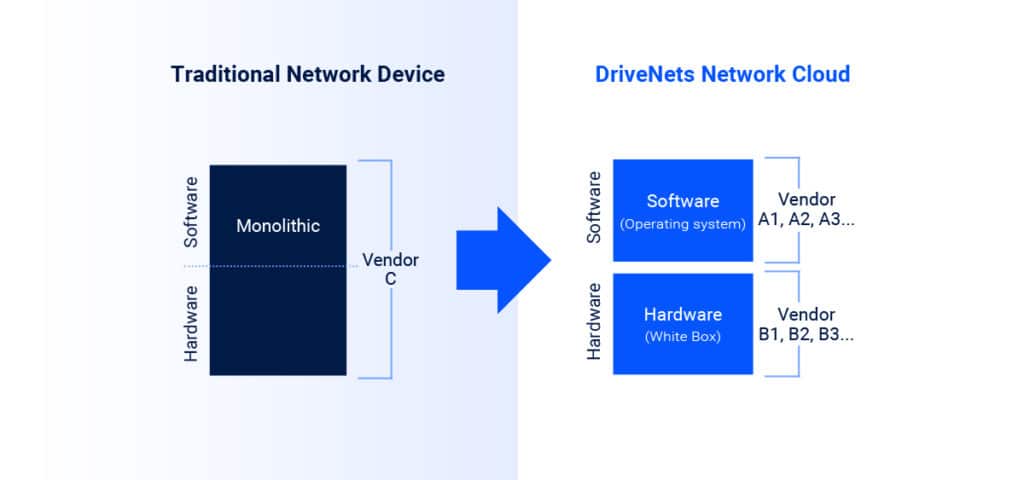

As mentioned in our previous post, traditional networking routing devices are based on closed, single-vendor proprietary hardware and software packages, offered by only a few large vendors. This results in vendor lock-in, which negatively affects procurement in numerous ways.

Supply chain vendor lock-in

Purchasing network equipment software and hardware from the same vendor weakens the procurement team’s negotiating position, as it eliminates the possibility to mix and match vendors. The scarcity of multiple competitors battling it out in the marketplace drives up costs and leads to reduced opportunities for cost savings and cost avoidance.

Service providers pay a substantial premium (ranging up to 300%) for closed branded network devices. This premium negatively impacts the procurement team’s ability to achieve its target price in the short run and keep down network expansion and upgrade costs in the long run.

Supply chain with hardware inconsistency

It’s interesting to note that although there are only a handful of large vendors offering single-vendor hardware/software routers, a traditional network has on average between

10-15 different network device models from 2-3 vendors. This is because service provider networks are typically built in silos, where each domain (broadband, mobile) has its own, dedicated hardware resources.

Procurement teams should consider the soft costs of maintaining a supply chain with such hardware inconsistency, which complicates network planning and operations. Such inconsistency also increases the cost of spare parts kept in the service provider’s warehouses.

On top of that, the closed single-vendor model slows down innovation since traditional vendors may be slower in introducing new and disruptive technologies than newer challengers looking to penetrate the market.

DriveNets modular networking software

Instead of continuing down the single-vendor “black-box” path, procurement teams should purchase best-of-breed networking hardware and software that are sold independently from a number of different vendors. In particular, procurement teams should closely consider DriveNets in their next bid process.

DriveNets Network Cloud transforms networks from hardware-centric to software-centric. This leads to simpler and standardized hardware across all network services (core, aggregation, edge).

Regarding software, DriveNets offers best-of-breed, modular networking software sold independently of the hardware. Service providers pay only for the features they need, either on a time-based, perpetual or subscription license (OpEx expense).

When it comes to hardware, DriveNets uses only two types of basic commercial off-the-shelf (COTS) “white-box” building blocks, which are available from multiple vendors. These two building blocks are common to all types of sites and all network functions. This makes the cost of spare parts and inventory significantly lower than with traditional networks, while shrinking the list of SKUs (stock keeping units) from a few hundred to only a dozen or so.

Lessen exposure to supply chain disruptions

DriveNets frees operators from vendor lock-in, allowing them to rapidly leverage new technologies, swap components and platforms, and switch vendors. Moving from a monolithic “black-box” model to an open “white-box” model lessens exposure to supply chain disruptions, empowers adopting new technologies from easily switchable open suppliers, and strengthens procurement negotiation model.

Not only that, but costs are also kept down due to the healthy competition between multiple vendors and economies of scale across all network services.

How Cloud-Native Networking Avoids Future Costs

Now let’s look at cost avoidance when it comes to routing and non-routing hardware.

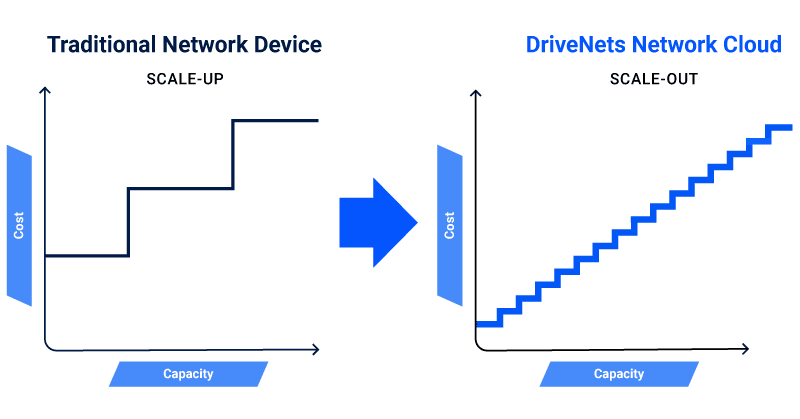

Network planners and procurement professionals usually have a tough choice when choosing a closed and inflexible network routing device for a specific network location.

One approach is to choose a device optimized for immediate capacity requirements. On the downside, the device will require replacement when traffic and services exceed its capabilities. When such a network box advances towards 70% capacity, typically the network team will urgently ask for more budget for a bigger box (lift & shift procedure).

Another approach is to invest in a larger device capable of handling future requirements. Unfortunately, this means high up-front CapEx and a large footprint of a partially populated box with initially underutilized network resources leading to further indirect costs (more on that below). Clearly, neither approach is ideal.

DriveNets Network Cloud

DriveNets Network Cloud disrupts traditional network economics by aligning network costs with capacity growth. Stacking of low-cost white boxes for incremental capacity upgrades on an as-needed basis – just like in cloud environments – lets you scale-out when and where needed. This avoids costly and unnecessary up-front investments and future upgrades.

Another key issue for procurement is the costs of non-routing devices. Typical network architecture includes some non-routing functions (such as security). Such functions usually require adding purpose-built hardware appliances that increase both direct “hard” costs (e.g., the hardware itself) and indirect “soft” costs (e.g., cooling and rack space consumption). Both types of costs become significant as the network scales and the traffic passing through these functions increases.

With DriveNets Network Cloud, however, those functions are added as service instances onto the existing cluster infrastructure. Just like installing and running apps on smartphones or clouds, additional containers are added via software. In most cases, no additional hardware is required, leading to cost avoidance of the additional non-routing hardware.

The Financial Value of Building Networks like Cloud

DriveNets empowers the procurement team to implement cost savings and cost avoidance measures on a network scale – saving the organization significant costs both at present and in the future.

Download eBook

5 Reasons Why You Should Include DriveNets in Your Next Network Bid Process