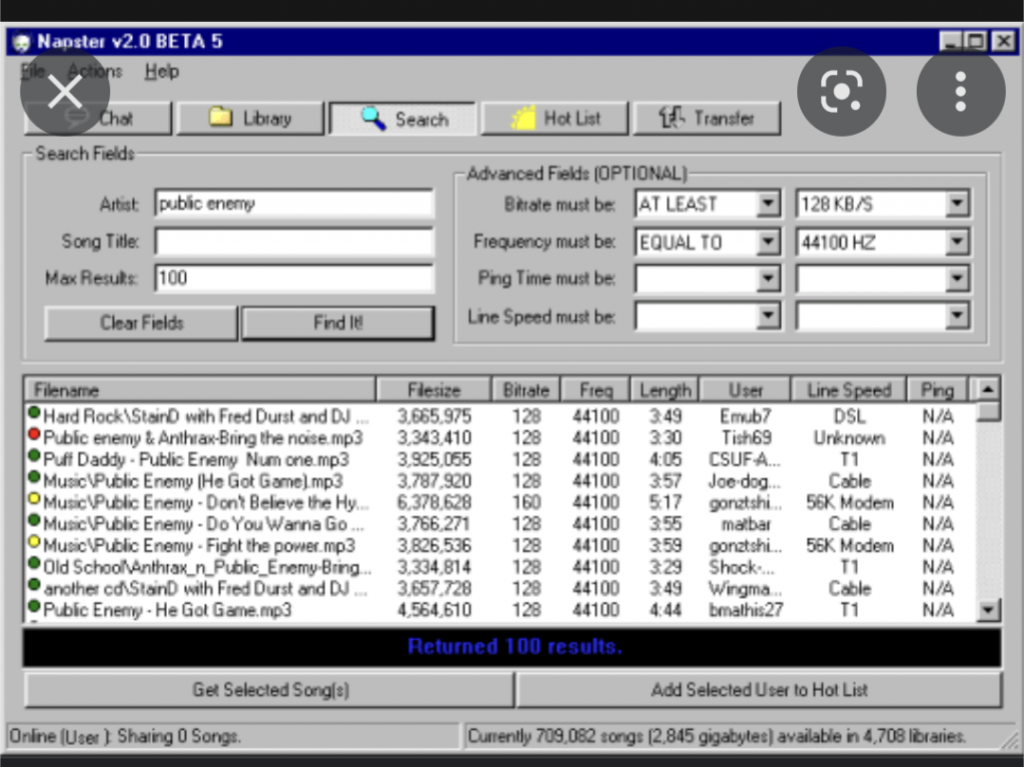

This was during the golden era of Napster, a revolutionary force that disrupted the music industry. Napster’s peer-to-peer technology changed music sharing and posed a challenge for legal action against copyright infringement, as it didn’t host any songs on its servers. Since then, much has changed. Napster eventually shut down, but its influence fundamentally changed the music industry. Without Napster, there might have been little incentive for the giants of the music industry to adopt innovations and new market strategies, like those pioneered by Spotify. Now, for just $12 a month, we can access almost any song and aspiring artists can share their creations with a global audience.

Napster changed the music industry

Disrupting the networking status quo

The on-premises data center industry suffered from a similar case of arrested development. Legacy vendors clung to their cash cow business models, resistant to anything that might disrupt their profits. That is, until Amazon Web Services (AWS) came and “Spotified” the on-premises infrastructure market with its flexible, scalable and cost-effective solution. Today, AWS’s cloud architecture is the preferred solution for building data centers.

Fast forward to today’s service provider (SP) networking scene, and we find a strikingly similar situation. Incumbent vendors are comfy, clinging to their monolithic chassis and centralized business models like a favorite pair of very worn-out jeans. Innovation? Flexibility? Openness? Nah, not on their agenda. Despite major shifts in the market and evolving customer expectations, most networks are still constructed using the same methods used 25 years ago.

This approach has led to excessively complex SP networks. Years of patches and upgrades have transformed them into a maze of service-specific equipment, each requiring unique skills for management, inflexible software update cycles, and a vast inventory of spare parts. Many even need dedicated teams for different parts of the network.

This method not only increases operational costs but also restricts service providers’ ability to innovate. Introducing new services becomes a months-long process due to the complicated operational matrix that needs realignment for each change. Additionally, it leads to a pileup of unused, idle hardware resources that cannot be easily repurposed for other services.

SPs have been seeking to reinvent their networks for many years. We’ve seen players like Cumulus, Pluribus, and Big Switch all play a role in breaking the traditional network model. Their solutions have given network operators more freedom and flexibility. However, the networking industry is now searching for a solution that goes beyond breaking barriers. The goal is A networking solution that provides flexibility, simplicity, and scalability, while being mature and robust enough for building live carrier-grade networks.

Stopping the upgrade cycle and deciding to reinvent networking

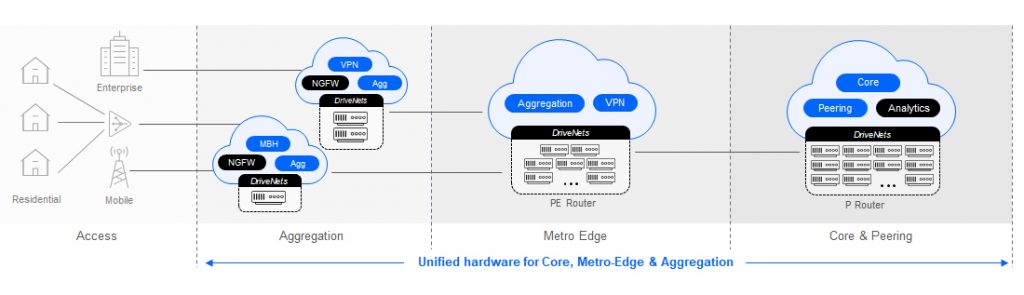

AT&T, a recognized leader in networking innovations, was among the first SPs to identify the limitations of hardware-centric networks. In 2013 the SP proposed a new network model to address emerging market requirements. This approach materialized in 2020 with an open, disaggregated routing network initially deployed in the core, utilizing the DriveNets Network Cloud software. it has since extended to the edge, leveraging its success in the core as a catalyst for encouraging Cisco to step out of its comfort zone and deliver a truly disaggregated network solution.

AT&T’s new core and edge network is based on a Distributed Disaggregated Chassis (DDC) design powered by DriveNets Network Cloud software and Cisco IOS XR software. This software-centric solution breaks down traditional monolithic routers into modular building blocks. DriveNets and Cisco software then pool these blocks to create any network function, such as core, peering or edge, using standard, low-cost white box hardware. These white boxes can range from a standalone 2.4T unit to a large 819Tbps cluster (DDC) composed of dozens of white boxes, all functioning as a single routing entity. This innovative network already powers more than 65% of AT&T’s traffic, delivering benefits such as simplified operations, elastic scalability, and reduced costs.

Build any network function, from core to edge , using the same standard, low-cost white box hardware

Similarly, a prominent cable operator in North America also recognized the need to reinvent its network architecture. It aimed for a simplified, scalable and flexible infrastructure to reduce both operational complexity and long-term costs. Its vision involved replacing its large legacy chassis routers with a regional, meshed and distributed network of standalone disaggregated white boxes. These standalone white boxes have high port density and integrated optical transponders, and can support all services (business, mobile and residential).

The new regional network’s reliance on simple 2-rack unit routing elements and a focus on automated lifecycle management significantly reduced its operational costs.

Despite facing similar challenges, these two network operators pursued different approaches to network design. This highlights the flexibility of disaggregated, software-centric networks – and another reason to embrace them.

The time is now to reinvent your network

The tier-1 service providers mentioned above have historically built their networks on traditional architectures. However, rather than continuing to implement more upgrades and patches, they have decided to reinvent their network with a new network architecture. While they are at the forefront, they are not alone in this process. Other service providers, including Vodafone, Telefonica, Orange, KDDI, and Turkcell, also are making significant steps in this direction.

The time for a change is now – stop upgrading your legacy network and explore how to reinvent it.

Related content for Service Provider Routing and Network Infrastructure

Download white paper

Which network architecture is right for you?